EBRD, EU provide fresh funds for Ukrainian MSMEs via ProCredit Bank

The European Bank for Reconstruction and Development (EBRD) is providing a loan equivalent to €25 million,

EBRD, EU support Ukrainian berry producer Amethyst Ole

Ukrainian king of antioxidants for European markets Can you imagine an organic food

Private Enterprise ‘Rusynska Miasna Company’ (RMC)

The core business activity of the RMC is pig breeding. Despite the COVID pandemic, the

Khrystyna’ Limited Liability Company

Located in Berezhany (approximately 90km from Lviv) the company ‘Khrystyna’ produces corrugated cardboard and products made

Ardenz Boiler Equipment Plant

The company ARDENZ is a Ukrainian manufacturer of steam boilers, metal tanks, reservoirs and containers. More than a

EBRD and EU support small businesses in Ukraine via Crédit Agricole

22 Apr 2021 The European Bank for

Improving animal welfare in pig farming

Zootechnologia LLC, a Ukrainian enterprise without foreign investments, is situated in the Kherson region.

Improving worker motivation and process efficiency in agriculture

‘Zlatopil’ is an agricultural company that has been operating since 1996.

Contributing to secure food supply

The company Vladana is an important agrarian enterprise located in the Suma region in North-Eastern Ukraine.

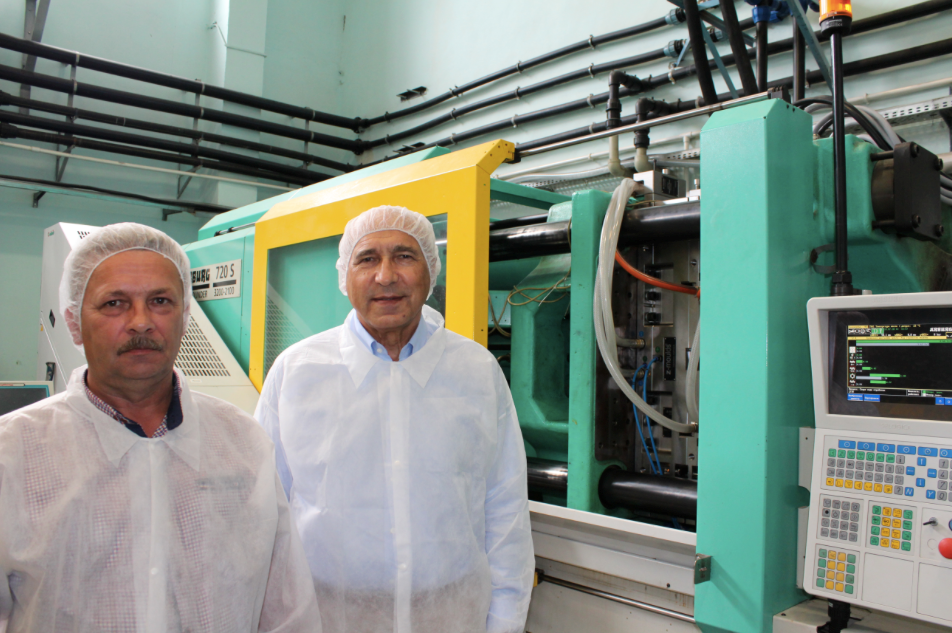

Reducing raw material input in bottle cap production

JSC “LACMA” is a plastic packing manufacturer, founded in 1992. The main products of the company are screw caps,